WHY SMA?

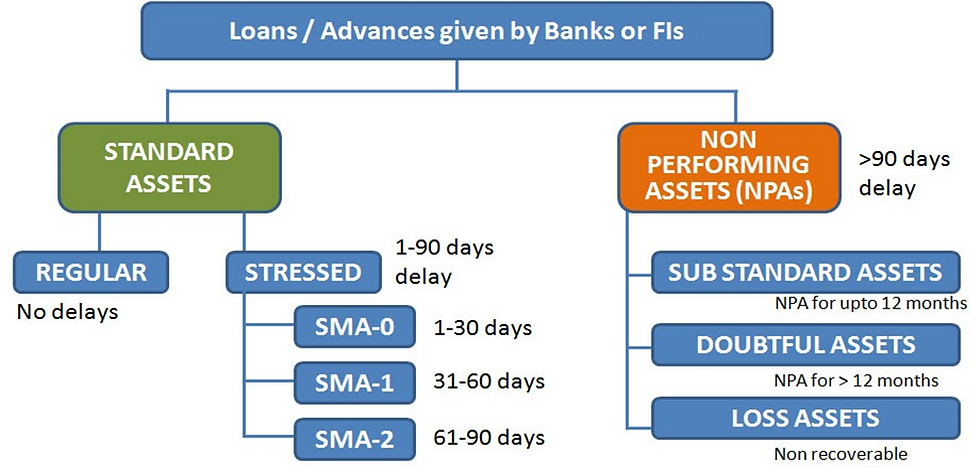

As per the guidelines issued by the country's apex bank- Reserve Bank of India, before a loan account turns into a Non-performing asset (NPA), banks are required to identify incipient stress in the account by creating Special Mention Account (SMA), one of the tools used by banks to monitor and manage potential risks.

SMAs are designed to identify stocks (loans) that are showing early signs of distress but have not yet defaulted. These accounts are a warning system to alert banks to the possibility of non-performing assets (NPAs) arising in the near future. Early identification of potential problems allows banks to take action, such as restructuring loans, working with borrowers to identify and resolve underlying problems, or increasing provisions to cover potential losses. This will help prevent the escalation of bad debts and reduce potential financial problems.

CLASSIFICATION OF SMAS

Primary (Urban) Co-operative Banks (UCBs) having total assets of ₹ 500 crore and more shall report credit information, including classification of an account as Special Mention Account (SMA), on all borrowers having aggregate exposures of ₹5 crore and above with them to Central Repository of Information on Large Credits (CRILC) maintained by the Reserve Bank. Aggregate exposure shall include all fund-based and non-fund based exposure, including investment exposure on the borrower. The same can be classified as follows:

SMA Sub-categories | Basis for classification Principal or interest payment or any other amount wholly or partially overdue for |

SMA-0 | 1-30 days |

SMA-1 | 31-60 days |

SMA-2 | 61-90 days |

In case of revolving credit facilities like cash credit, the SMA sub-categories will be as follows:

SMA Sub-categories | Basis for classification Outstanding balance remains continuously in excess of the sanctioned limit or drawing power, whichever is lower, for a period of |

SMA-1 | 31-60 days |

SMA-2 | 61-90 days |

But some 'Special Mention' assets are identified on the basis of other factors that reflect sickness/irregularities in the account (SMA -NF). In the case of SMA -NF, non-financial indications about stress of an asset is considered.

DEFAULTS: WARNING SIGNALS

Thus, the ‘Special Mention’ category of assets are considered not only on the basis of the non-repayment or overdue position of the loan accounts but also due to other factors that reflect potential sickness/irregularities in the account (SMA -NF). These are called in banking parlance, “Early Warning Signals (EWS)”

These “Early Warning Signals” are intended to alert the local bank management to the fact that if no corrective appropriate action is initiated on the SMAs well in time, then such accounts may turn bad and become NPAs.

It should be noted that no provisioning is done for the SMA assets at this stage, as the loan has not yet become NPA.

CORRECTIVE ACTION PLAN BY JLF.

The Joint Lender's Forum, or JLF, looks into a number of options to ease the account's stress. The goal is to find a quick fix that will protect the lenders' loans as well as the economic worth of the underlying assets, and not to promote a specific resolution strategy like restructuring or recovery. Generally, the JLF's Corrective Action Plan alternatives would consist of:

(a) Rectification - Obtaining a specific commitment from the borrower to regularise the account so that the account comes out of SMA status or does not slip into the NPA category. The commitment should be supported with identifiable cash flows within the required time period and without involving any loss or sacrifice on the part of the existing lenders. If the existing promoters are not in a position to bring in additional money or take any measures to regularise the account, the possibility of getting some other equity/strategic investors to the company may be explored by the JLF in consultation with the borrower. These measures are intended to turn-around the entity/company without any change in terms and conditions of the loan. If considered necessary, the JLF may also consider providing need based additional finance to the borrower as part of the rectification process. However, it should be ensured that additional financing is not provided with a view to ever-greening the account.

(b) Restructuring - If it is prima facie viable and when the borrower is not a wilful defaulter, i.e., there is no diversion of funds, fraud or malfeasance, etc, only then the possibility of restructuring the account is considered by JLF. At this point, promoters commit to extend their personal guarantees along with their CA certified net worth statement supported by copies of legal titles to assets along with a declaration that they would not undertake any transaction that would alienate assets without the permission of the JLF. Any deviation from the commitment by the borrowers affecting the security/recoverability of the loans may be treated as a valid factor for initiating recovery process. For this action to be sustainable, the lenders in the JLF may sign an Inter Creditor Agreement (ICA) and also require the borrower to sign the Debtor Creditor Agreement (DCA) which would provide the legal basis for any restructuring process. The formats used by the Corporate Debt Restructuring (CDR) mechanism for ICA and DCA could be considered. Further, a ‘stand still’ clause could be stipulated in the DCA to enable a smooth process of restructuring. The ‘stand-still’ clause does not mean that the borrower is precluded from making payments to the lenders. The ICA may also stipulate that both secured and unsecured creditors need to agree to the final resolution.

The decisions agreed upon by a minimum of 75% of creditors by value and 60% of creditors by number in the JLF would be considered as the basis for proceeding with the restructuring of the account, and will be binding on all lenders under the terms of the ICA. However, if the JLF decides to proceed with recovery, the minimum criteria for binding decision, if any, under any relevant laws/Acts would be applicable.

(c) Recovery - Once the first two options at (a) and (b) above are seen as not feasible, due recovery process may be resorted to. The JLF may decide the best recovery process to be followed, among the various legal and other recovery options available, with a view to optimising the efforts and results.

However, The JLF is required to arrive at an agreement regarding the option to be adopted for CAP within 30 days from:

The date of an account being reported as SMA-2 by one or more lender, or

Receipt of request from the borrower to form a JLF, with substantiated grounds, if it senses imminent stress.

Further, the JLF should sign off the detailed final action plan within the next 30 days from the date of arriving at such an agreement.

CIBIL/ CREDIT REPORT:

CIBIL Score is a numeric summary of your credit history. The score is derived using the credit history found in the CIBIL Report / Credit Information Report. It is a detailed record of a person's or an entity’s credit history and repayment activity. The report contains details regarding the credit accounts, including credit cards, loans, and other credit facilities.

When an account is classified as SMA, it will negatively impact the CIBIL score, because an account is classified as SMA if the payment is overdue for a certain period of time. A small delay in repayments reduces the credit score.

If the lender classifies any loan or OD account as SMA or NPA, then the same is reported to the credit bureaus like Experian, CRIF and CIBIL and the credit score of the borrowers as well as the guarantors will drop.

The consumer CIBIL of an Individual should ideally have a score that is closer to 900 as it helps a person to get better deals on loans and credit cards. Generally, a CIBIL score of 750 and above is considered as ideal CIBIL/credit score by majority of lenders.

However, in case of an entity i.e. public limited companies, private limited companies, partnership firms or proprietorship firms the commercial CIBIL which shows CMR rankings is extracted. Commercial credit reporting is similar to consumer credit reports but specifically for businesses to assess risk in extending loans, insuring businesses, underwriting insurance risk, purchasing businesses, investing in businesses and most of all in shipping goods to business on credit terms.

CMR RANKS | MSME CATEGORY |

1-3 | These have a good track record and have no amount pending in their name. |

4-7 | They have failed obligations, but they won't become NPA (Non-performing Asset) |

8-10 | There is a high chance that these will become an NPA in the course of the next 2 years |

HOW SMA AND NPA ARE DIFFERENT?

In conclusion, the implementation of Special Mention Accounts (SMA) as mandated by the Reserve Bank of India serves as a proactive measure for banks to identify and manage early signs of financial distress in loan accounts before they deteriorate into Non-Performing Assets (NPAs). By classifying and monitoring these accounts based on overdue criteria and other warning signals, banks can undertake timely corrective actions, such as rectification or restructuring through the Joint Lender’s Forum (JLF), to safeguard their financial stability. The early detection and management of potential credit risks not only help in preserving the economic value of assets but also mitigate the adverse impact on credit scores, thereby fostering a healthier financial ecosystem.

Comentarios